- #MONEYSPIRE BILL PAY HOW TO#

- #MONEYSPIRE BILL PAY FULL VERSION#

- #MONEYSPIRE BILL PAY PRO#

- #MONEYSPIRE BILL PAY SOFTWARE#

- #MONEYSPIRE BILL PAY TRIAL#

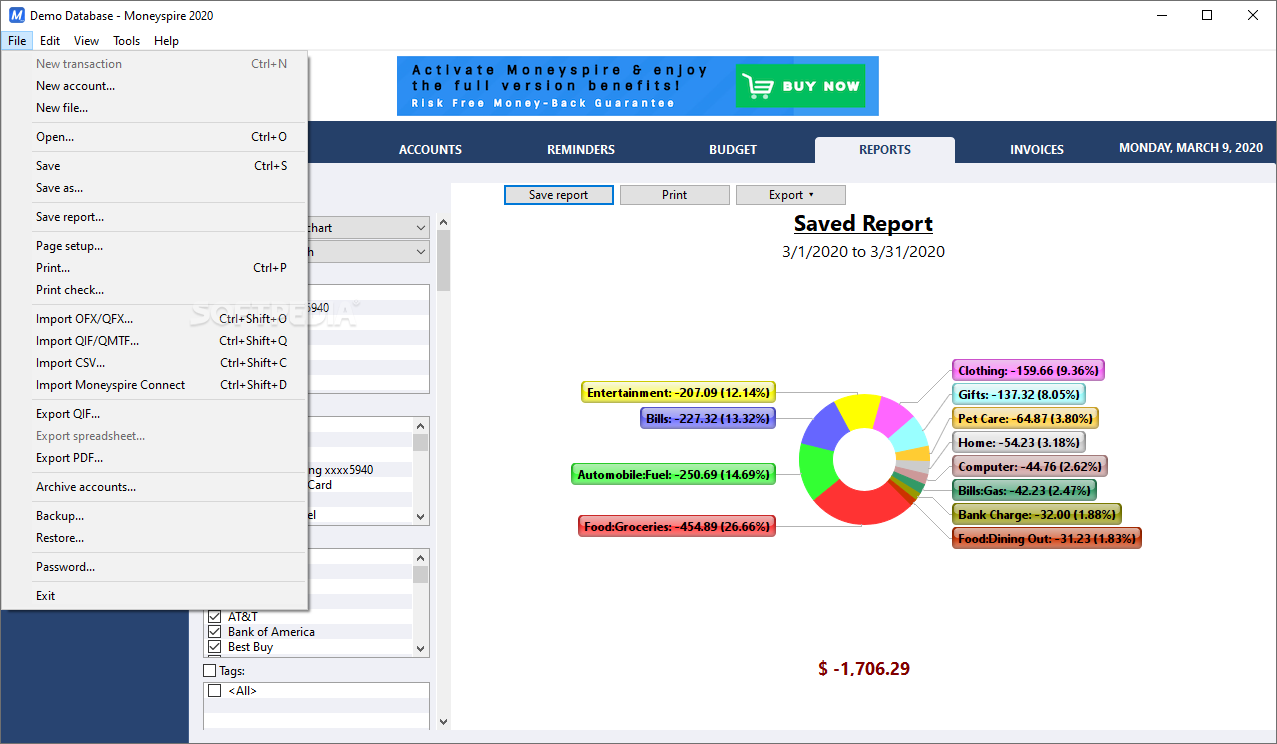

You can buy a license to activate the full version features. Set a budget to keep track of your spending so you dont overspend on specified categories like Dining Out. Keep track of your bills so you never forget to make a payment again and avoid late fees. Categorize your spending and income with customizable categories. Review the payment amount and change if necessary. Keep track of your bank accounts, credit cards, loans, cash or investment accounts. To pay more than one bill, repeat these steps for each account.

If you manage multiple accounts, choose the bill you want to pay.

#MONEYSPIRE BILL PAY HOW TO#

Categorize your spending and income with customizable categories. If your account has a passcode and you forgot it, learn how to reset or change it.

#MONEYSPIRE BILL PAY SOFTWARE#

After 15 days, the software will switch to the free version, which is limited to managing 1 account. Keep track of your bank accounts, credit cards, loans, cash or investment accounts.

#MONEYSPIRE BILL PAY TRIAL#

This product starts with a free 15 day trial version where you can try all the features out.

#MONEYSPIRE BILL PAY PRO#

Create customer invoices with the Pro version. Optionally sync to the cloud (if you would like) via the Moneyspire Cloud feature so you can share your finances between multiple computers and mobile devices. Be reminded of your bills Set bill reminders and see all your upcoming payments so you never forget to pay a bill again. Click Change Login to change the username and password for the connection, and then click Test. and organize your transactions and see where your money is going. Moneyspire will never force you into a subscription or upgrade, and does not disable your features Moneyspire is a budgeting tool designed to synchronize all your financial accounts in one place so you can easily track your income and spending. Track your accounts Keep track of your bank accounts, credit cards, etc. Optionally sync to your financial institutions (if you would like) via the Moneyspire Connect feature and automatically download your transactions. Get your financial life in order and know where you stand with Moneyspire. Generate detailed reports to see exactly where your money is going and to make tax time easier. Balance your checkbook and reconcile with bank statements to catch errors and bank fraud. Forecast your account balance to prevent overdrafts and insufficient funds.

/monthly-bill-payment-checklist-5823abf83df78c6f6af4c36d.png)

Set a budget to keep track of your spending so you don't overspend on specified categories like Dining Out. Experience the better way to pay your bills online, anytime. Categorize your spending and income with customizable categories. Pay Your Bills Online BillExpress is the free, fast, and safe online bill payment service for people who value their time and money. It doesn’t provide tax reports or export your data to tax programs, although you can download the information in a CSV format that’s compatible with Excel (and other programs).Keep track of your bank accounts, credit cards, loans, cash or investment accounts. One place this financial management software falls short, however, is in tax preparation. You may want to check out more software, such as PLCash, Inertia or TraderTerminal, which might be similar to Moneyspire. Moneyspire can even forecast your future balances based on scheduled transactions. Set bill reminders and see all your upcoming payments so you never forget to pay a bill again. Moneyspire allows you to monitor your spending, cash flow and net worth, presenting the reports in graphical form to help you get a quick, intuitive view of your budget and progress. Another nice feature of the Plus account is the ability to pay bills online directly through this program. While setting up your initial budget can take some time since you must assign each transaction to a category in order to track your spending, once that’s done, Moneyspire lets you copy that budget to subsequent months. Moneyspire features several convenient budgeting tools to help you track spending and determine where you can cut costs. Moneyspire’s connection tools make the linking and updating process easy. It takes the burden of regularly importing your account data off you. This is a vital feature for personal financial software. Once connected, the software can automatically download your transactions. If you want full-featured personal accounting software, the Plus account is a better option than the Basic account because you can link to your bank, credit union, investment and credit card accounts.

Those can be useful, especially toward the end of a pay period, but it’s still a capable personal finance software application worthy of consideration. It lacks the goal-tracking and budget alerts that Quicken and Mvelopes offer. Moneyspire is easy-to-use personal finance software that can help you track your budget, pay your bills and, with its Plus program, keep an eye on your investments.

0 kommentar(er)

0 kommentar(er)